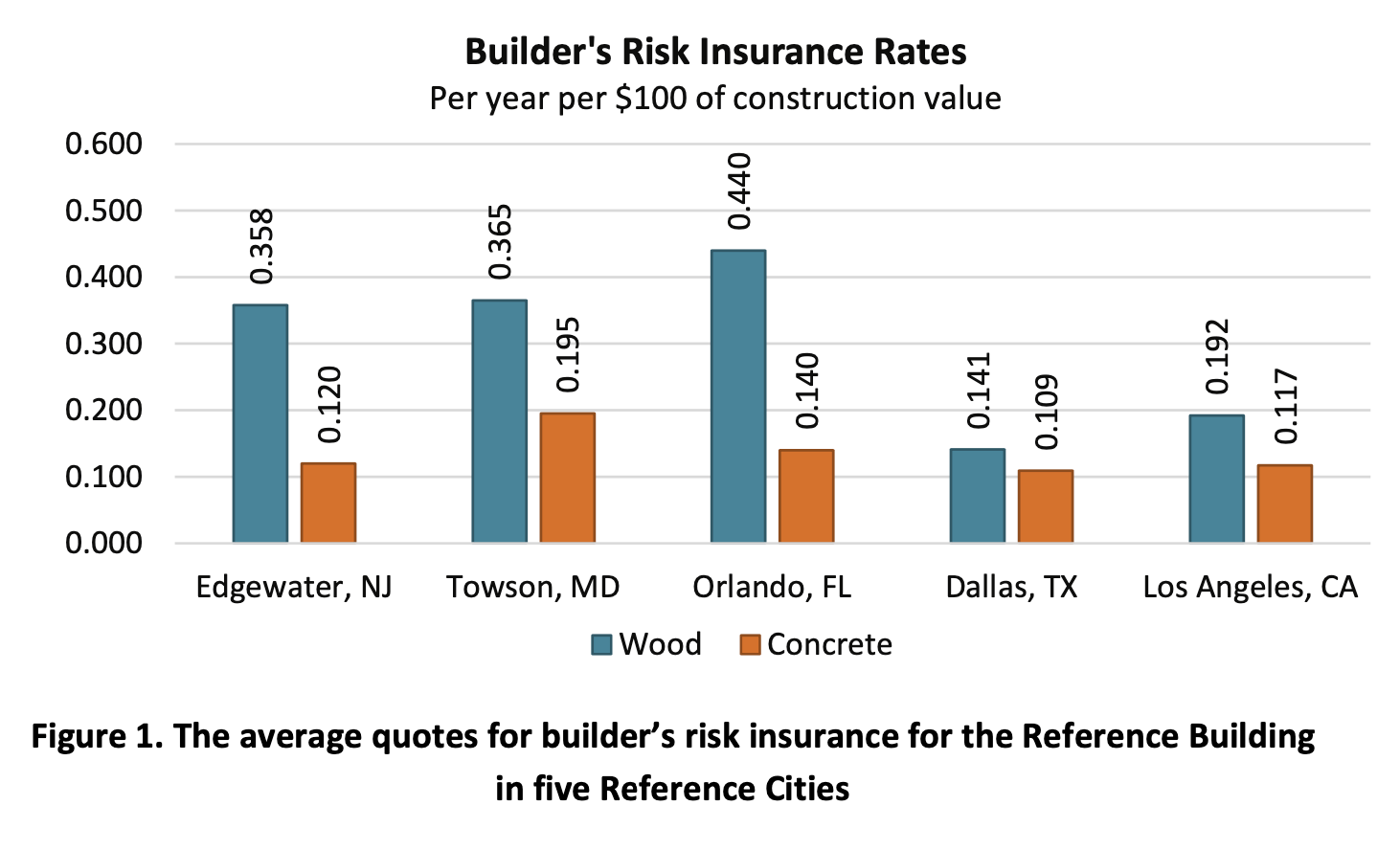

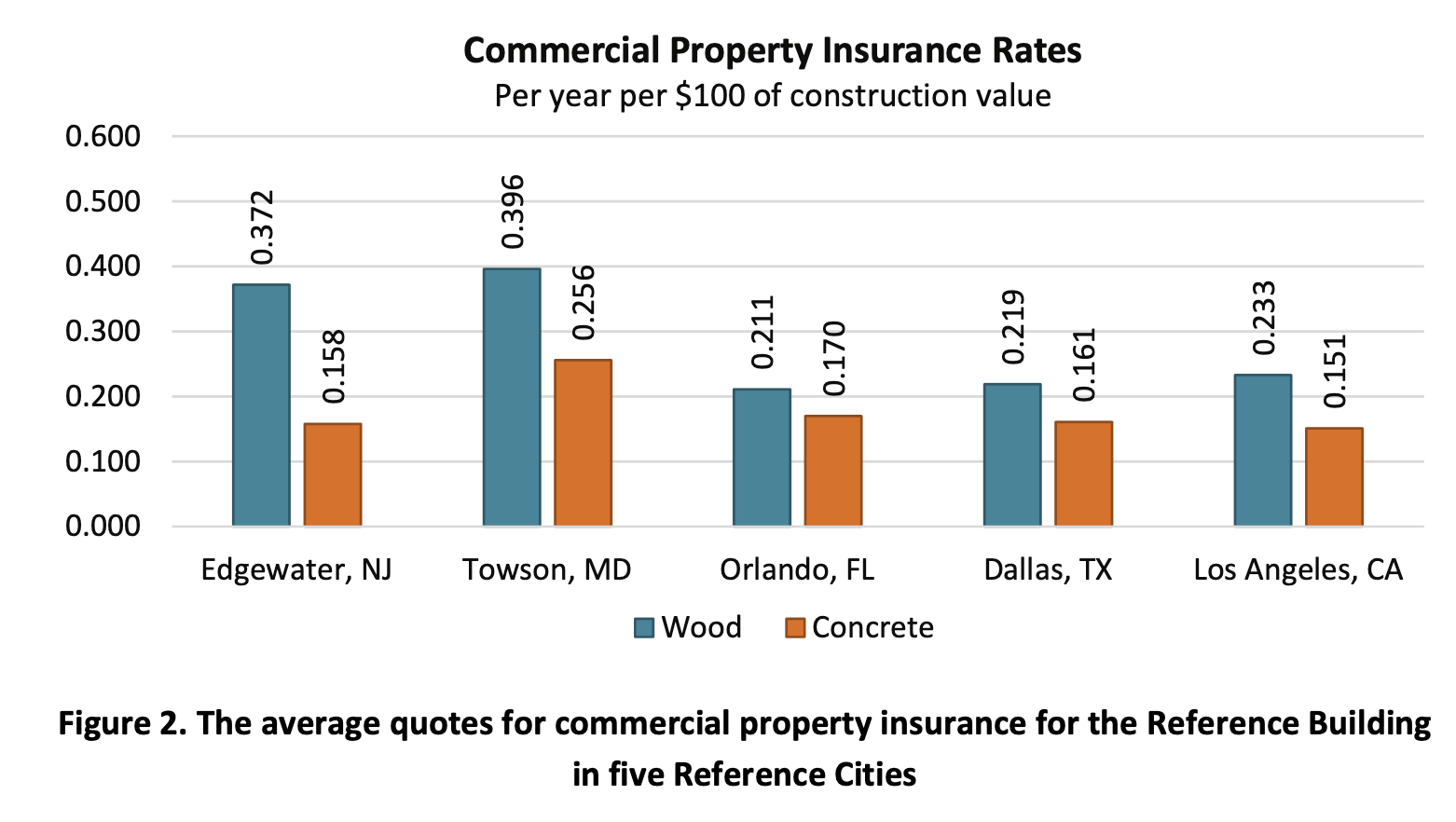

The study collected insurance premium quotes for builder’s risk insurance (during construction) and commercial property insurance (during occupancy) for a Reference Building built using combustible construction (wood‐frame) and non‐combustible construction (concrete) in five Reference Cities to estimate the difference in insurance premiums for these types of construction.

The Reference Building is a 100,000‐square‐foot, 4‐story apartment building with 15 one‐bedroom apartments and 8 two‐bedroom apartments per floor. The Reference Cities are Edgewater, NJ; Towson, MD; Orlando, FL; Dallas/Fort Worth, TX and Los Angeles.

Other notable takeaways from the study include:

-

Because of the increase of apartment fires insurance carriers will likely increase their premiums on wood framed construction in the future.

-

In all parts of the country, building with concrete will lower your builder’s risk and property insurance by varying degrees and you should check with your own carrier.

-

Companies providing insurance for wood framed buildings might require addition subjectivities to mitigate loss. The additional costs of guards, fencing and detailed fire prevention plans might be needed to be added to your budget in order to be underwritten.

More recently, in a cost comparison analysis in 2021, it stated the Builder’s Risk and Owner Liability Insurance can be reduced by as much as 35% to 50% by utilizing ICF’s storm-resistant, resilient exterior building shell. This claim was derived when comparing the builders risk insurance costs of an 88-unit wood framed hotel with the same hotel build with concrete.