Add $850,000 to Your Building’s Value During the Design Phase

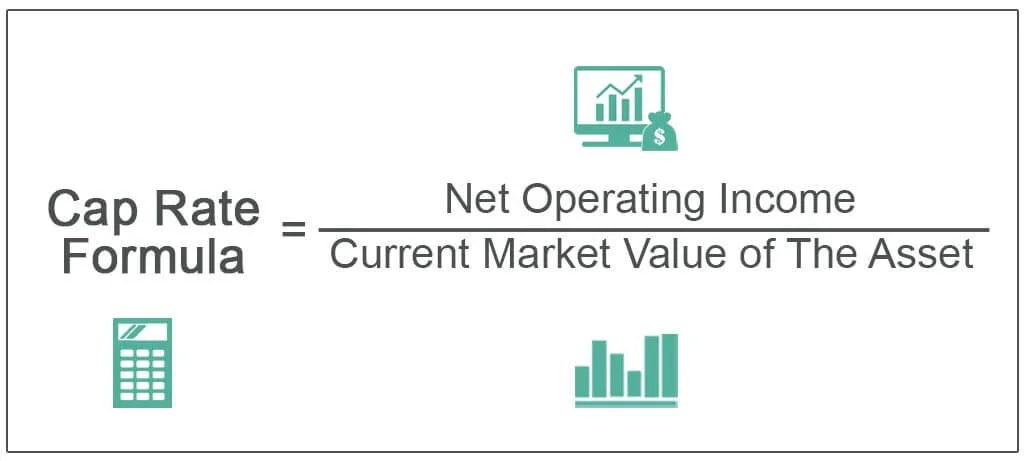

When we talk about building a better building we refer to the strength, total cost of ownership, energy performance and resistance to fire and natural disasters. But the most important feature of building better is the value created when that building is completed and operational. We all understand the concept of cap rates and return on investments on commercial buildings. The cap rate is your net operating income divided by the market value of the asset.

When you build with materials that lower your insurance and energy costs you can lower your monthly expenses and increase the Net Operating Income. At a constant cap rate you will increase the value of your asset.

Clients often try to save money on first cost construction by building with wood. This strategy lowers up front costs but increases your operating cost which in turn costs you every month and lowers the value of your asset when you go to refinance or exit the market.

In many multifamily markets the common practice is to provide individual meters for each unit. But more value can be made during the design phase by having a energy efficient building and rolling the expected utilities cost into the rent. The energy savings is realized by the ownership and not by the occupant.

FOR EXAMPLE:

If you have a four story, 88 unit hotel and the yearly revenues were $ 4,454,560 and the total operating expenses were $ 2,848,032 the net operating income would be $ 1,606,528. If people are valuing your property at a 6% cap rate the building is valued at $ 26,775,467

By using ICF in the construction process, you can reduce the energy costs by 25% or roughly $ 31,500 and reduce your insurance costs by $ 19,250. This would Increase your NOI by $50,750 at the same 6% cap rate the building would be worth $ 27,621,300 or almost $ 850,000 more than a wood framed building.